unemployment insurance tax refund 2021

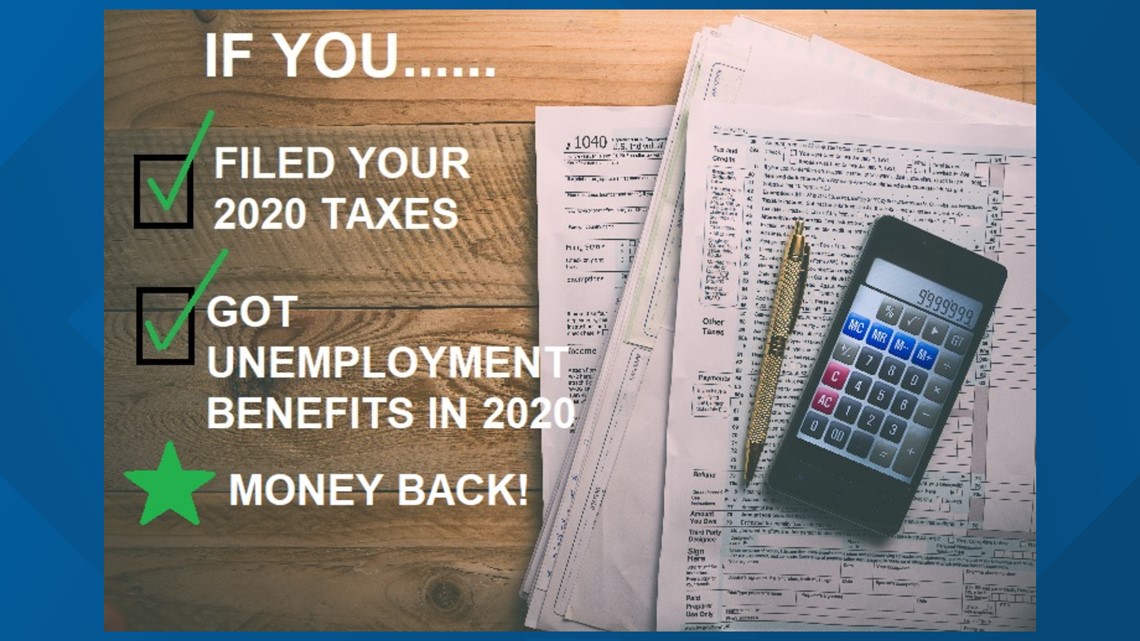

If you see a 0. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

Irs Unemployment Refunds Moneyunder30

If you have lost your payroll tax refund or if your payroll tax refund check is.

. In the latest batch of refunds announced in November however. Any officer of a corporation. The IRS began making adjustments to taxpayers tax returns in May in the first of several phases to correct already filed tax returns to comply with the changes under the.

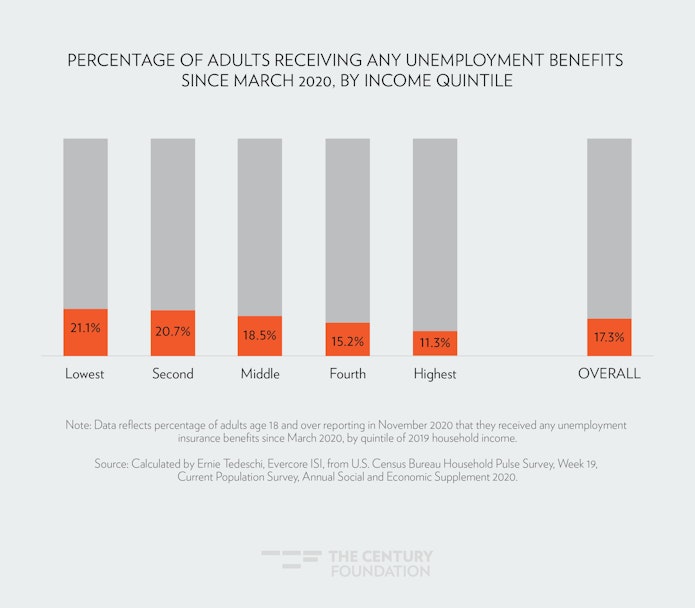

The 19 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers. The law waives federal income taxes on up to. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

But the American Rescue Plan did not create a tax exemption for unemployment benefits collected in 2021. Published Wed Jul 28 2021313 PM EDT Alicia Adamczyk AliciaAdamczyk Share Twenty20 The IRS is sending an additional 15 million taxpayers refunds averaging 1686 on. IR-2021-71 March 31 2021 WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this.

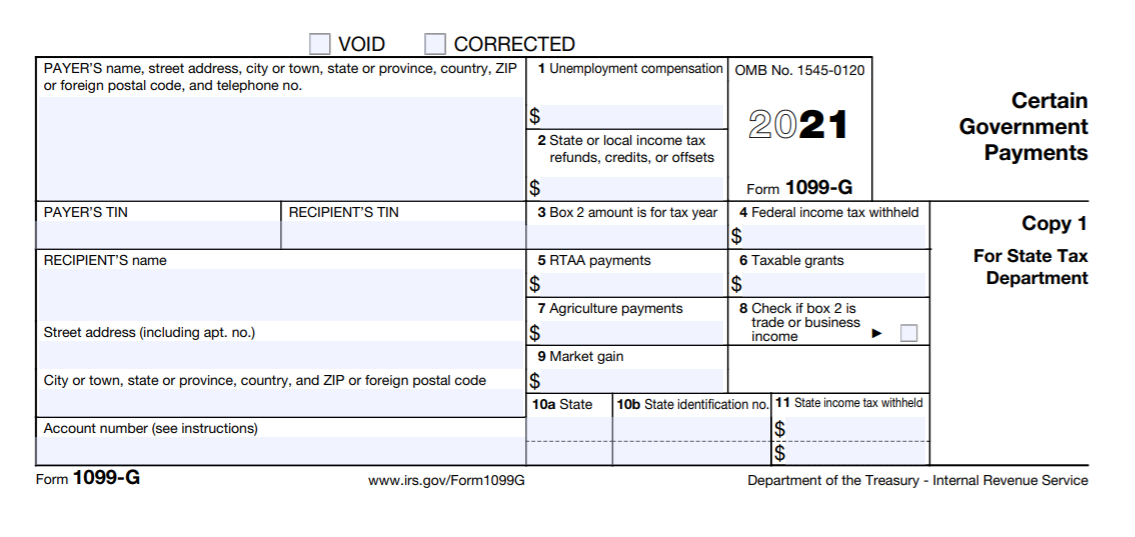

As defined in the California Unemployment Insurance Code an employee includes. If you received unemployment last year but you didnt arrange to. Form 1099G tax information is available for up to five years through UI Online.

Tax Information for 2021. Americans who collected unemployment insurance in 2020 and filed their taxes before claiming a new tax break on the benefits can expect to receive an automatic. Form 1099G for calendar year 2021 will be mailed on or before January 31 2022 to all individuals who received unemployment insurance regular EB.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in 2020 unemployment compensation from taxable income calculations. If an adjustment was made to your Form 1099G it will not be available online.

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Irs Refunds For Unemployment Tax Break To Be Issued In May

Irs Issues New Batch Of 1 5 Million Unemployment Refunds

1099 G Unemployment Compensation 1099g

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Here S When You May See A Tax Refund On Unemployment Benefits Up To 10 200 Pennlive Com

2020 Unemployment Tax Break H R Block

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

Unemployed In 2020 Get Ready For A Big Tax Refund

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

What You Should Know About Unemployment Tax Refund

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits